SVB is a canary in a coal mine

Why it failed, how The Fed goofed, and what's next for crypto

This work is supported by excellent patrons and organizations.

Subscribe to join the 1600+ nerds mapping and building the frontier.

This weekend, much of the tech & finance world was doomscrolling:

Why fret?

Well, on Thursday, Silicon Valley Bank (SVB) had the largest bank run in history. Depositors pulled out $42B in one day. That’s $1M per second for ten hours straight.

The internet helps us speedrun a bank run.

On Friday, SVB failed and the FDIC stepped in. SVB’s market cap was $200B, so this is the second-largest bank failure in history, just behind Washington Mutual’s $300B failure during the Great Financial Crisis.

People were confused:

Then on Saturday, we responded to the crisis.

On the left:

While ~libertarian techies called for intervention:

The answer, IMO, was pretty clear—backstop depositors:

By end of day Sunday (or as the cool kids say “before the Asian markets opened”), the FDIC had issued a statement. They would backstop depositors. Hooray!

Crisis averted.

Now let’s take a step back:

I. Did The Fed do the right thing?

II. Who Dunnit? SVB or The Fed?

III. Is this crypto’s fault? Or maybe crypto can help?

IV. What next?

I. Did The Fed do the right thing?

YOLO Yellen did the right thing. Humanity really does “only live once” and letting the bank run continue would’ve been, as Garry Tan noted, an extinction-level event for startups.

Imagine it like the 2001 dot-com crash, except you’re wiping out all startups, not just the bad ones. No Google, no Autodesk, no Adobe, no Etsy, no Kickstarter. In 2023 that would mean hurting at least 1500 climate tech startups too.

As a reminder, this didn’t just randomly occur. It required thousands of hard-working operators dedicating their weekend to this. The group chats I’m in were heads down.

This isn’t to gloat or to excuse the mistakes SVB made. More just to highlight that many honest, well-intentioned folks are trying their best.

This was in stark contrast with VC & Media Twitter, who seemed to be shouting even more than normal. 😂

Remember, operations work is anti-memetic (there’s no livestream of your 9-to-5), while “shouting from the rooftops” spreads memetically. Assume that, for every 1 person shouting, there are 100 folks heads down at work, then going home to play with their kids.

II. Who Dunnit? SVB or The Fed?

Who is at fault? SVB? The Fed? Why not both? Porque no los dos?

To look at why SVB is to blame, we need to look no further than truly vintage Bernie speaking in 2018:

“In 2008, 15M families lost their homes to foreclosure and $13T in wealth was lost by American families.

Now, the banks (including SVB) are back to deregulate. This bill would make it more likely a bank with $100B to $200B in assets would fail.”

SVB did indeed fail.

Oh, deregulation. So innocent and naive.

But The Fed is to blame here too. They pumped and dumped a shitcoin—10-year mortgages with 1.5% interest:

These shitcoins are called “Mortgage-Backed Securities” (MBS) that need to be “Held-To Maturity” (HTM). When the interest rate goes up, as it did in record time, those assets decrease in value.

SVB had unrealized losses of $16B on these securities. $16B is a lot. Sounds like SVB is to blame, right?

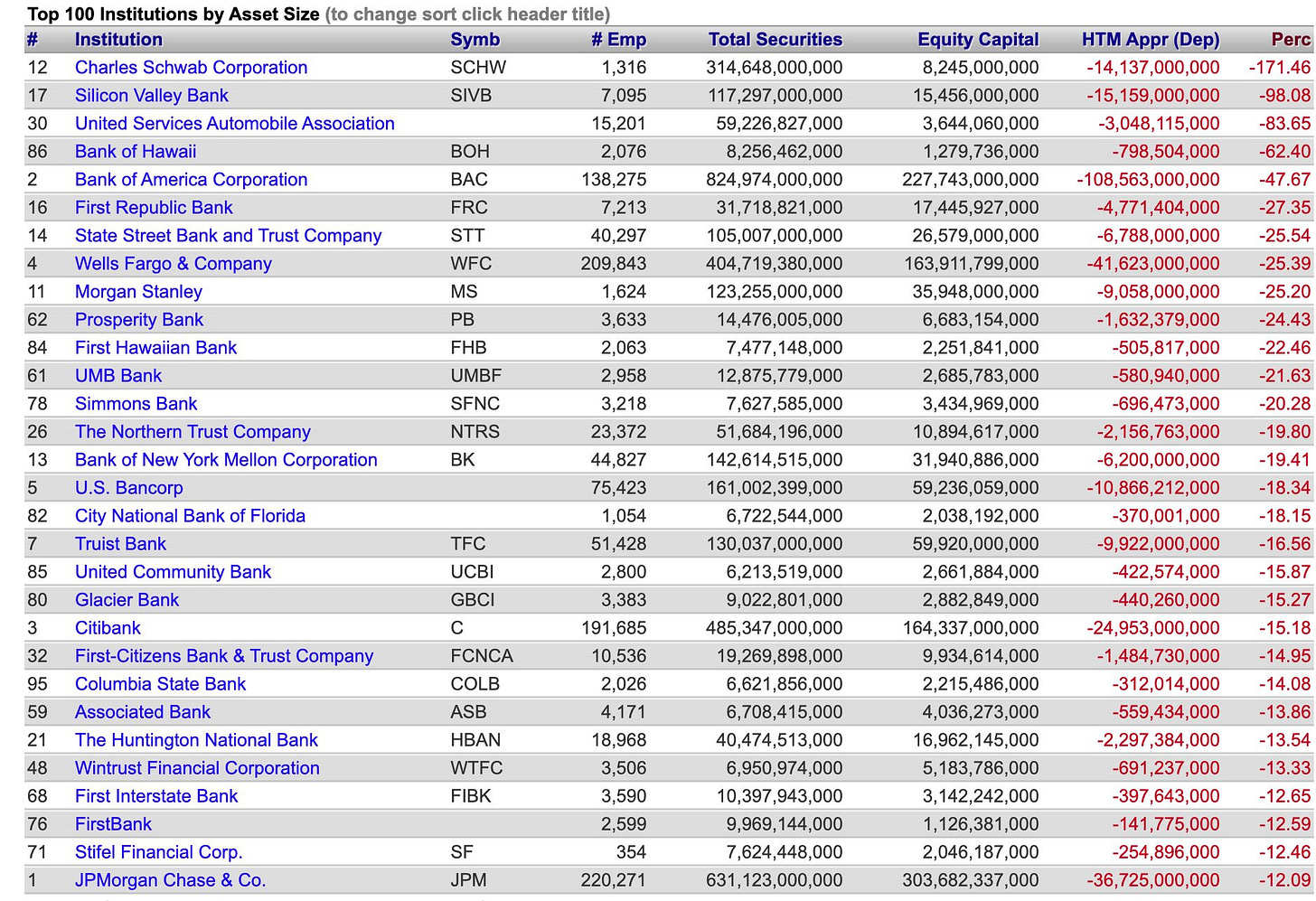

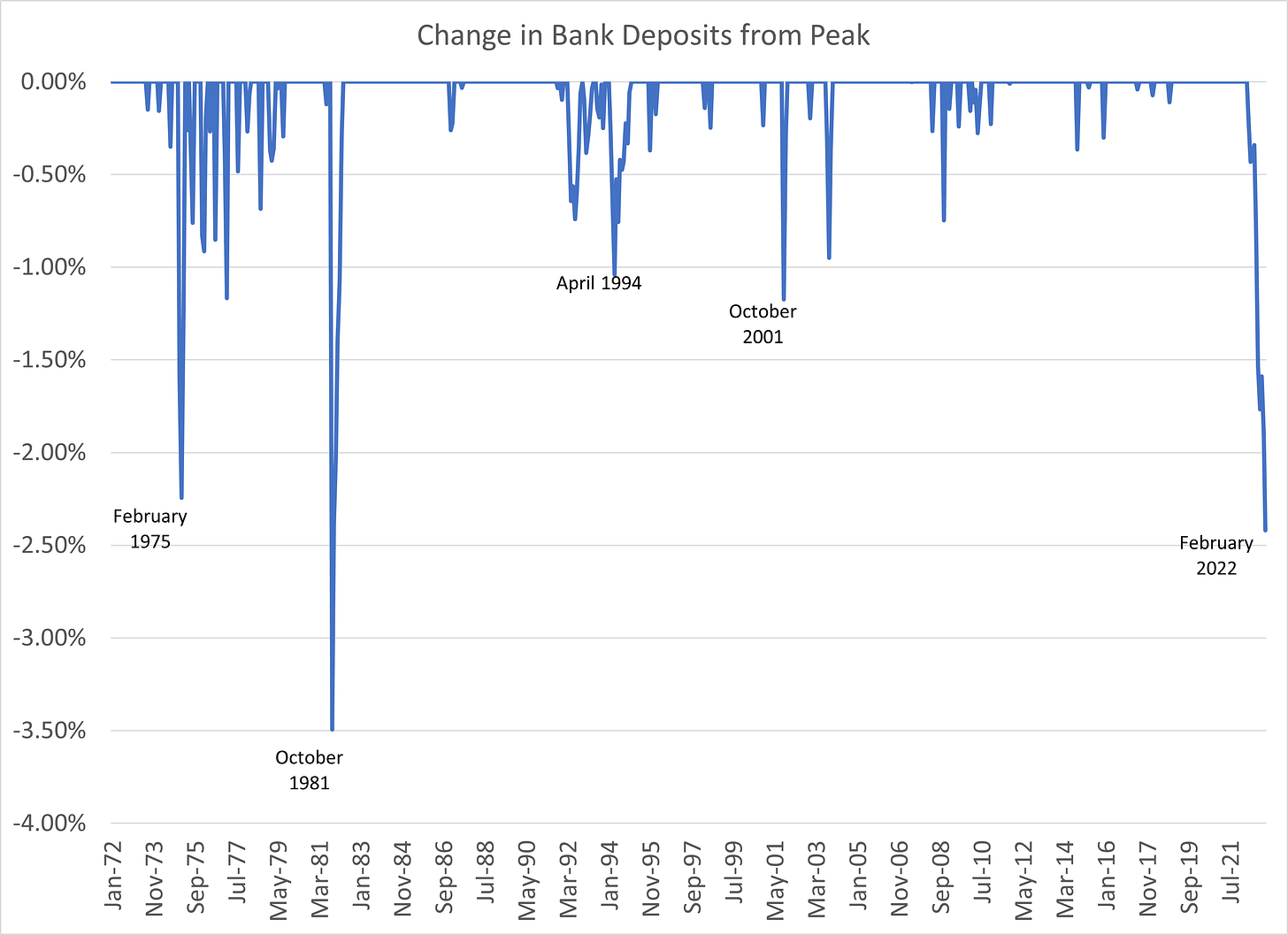

Maybe not. The banking sector as a whole has $620 BILLION of unrealized losses. SVB is just 2.5% of that. The graph below shows that $620B on the far right.

Why haven’t we heard about these losses? The Fed has a (dumb) rule that you can’t mark to market these losses! They’re forced to stay unrealized. Noice.

It’s not just SVB that failed. The two largest crypto banks failed too, Silvergate ($10B AUM) and Signature ($100B AUM). First Republic Bank didn’t fAiL, but got a sweet ten billy (that’s $10B) from JPMorgan, plus the Fed backstop.

The first dominoes to fall, SVB and Silvergate, were at the end of the risk curve. They had tons of interest-rate exposure, which led to an illiquid supply of money. But they had tons of tech-based deposit exposure, which led to lots of demand for their assets. Lots of demand + illiquid supply = bank run.

There are other exposed banks too. Below is a sorted list of Held-To-Maturity losses, divided by company equity.

Near the top you can see SVB had about as many HTM losses as equity. -98%. Bad! But at -171%, Schwab isn’t looking too good either. (Luckily, 80% of Schwab depositors fall under FDIC’s 250k limit.)

The overall picture: Total bank equity is $22T. Total HTM unrealized losses are $620B. Aggregate ratio is -28%. Not great.

What does this all mean?

As my childhood friend would say: If everyone tells you you’re drunk, go home.

As I would tell The Fed: If all commercial banks have large unrealized losses, it’s probably your fault.

You can’t hike rates like this and expect nothing to break:

No matter what you put on the y-axis, it doesn’t look great. Deposits are being pulled but the money is locked up in long-term assets. “Duration mismatches” everywhere you look.

(One side note: After the 2008 crash, Mortgage-Backed Securities got a bad brand. But the MBS’s of 2023 are much better than those in 2008. 2023 has high-quality, organic, locally sourced MBS. 2008 had trillions of dollars of subprime MBS. V different.)

III. Is this crypto’s fault? Or maybe crypto can help?

Two crypto banks failed. So expect crypto stories like this:

Or this:

But why did those two crypto banks actually fail? As Nic Carter explains, it’s all part of Operation Chokepoint 2.0. The US government is pushing crypto banks offshore.

The first domino was FTX. It was pushed to the Bahamas, where it was regulated on Island Time.

FTX depositors haven’t gotten their money back because a) The government doesn’t care about anons, and b) it’s magic internet money aka FTT.

FTT’s main use was to prop up SBF’s afro. At least 10-year MBS can be Held, To, Maturity. Or with The Fed’s new fancy banking facility, the Bank Term Funding Program (BTFP), you can just use 10-year MBS as collateral for money today! The magic of The Fed.

Besides FTX, Operation Chokepoint 2.0 made it harder for “normal” banks to cater to crypto. This meant that Silverpoint and Signature were two of the main banks that could really bank with crypto (others still exist ofc). 25% of Signature’s deposits were from the crypto sector.

It sure is lonely out there at the far end of the risk curve.

Eggs. Basket. Bank. Run.

Though who knows if Signature actually needed to be shuttered. Maybe SVB’s bank run was just cover for this operation.

From Nic Carter again:

idk.

¯\_(ツ)_/¯

Still, there is hope within the crypto world. No one wants bank runs.

BoomerFi regulates with law. For example, Dodd-Frank and Basil III require this word salad: “High Quality Liquid Assets” in a “Liquidity Coverage Ratio” above 100%.

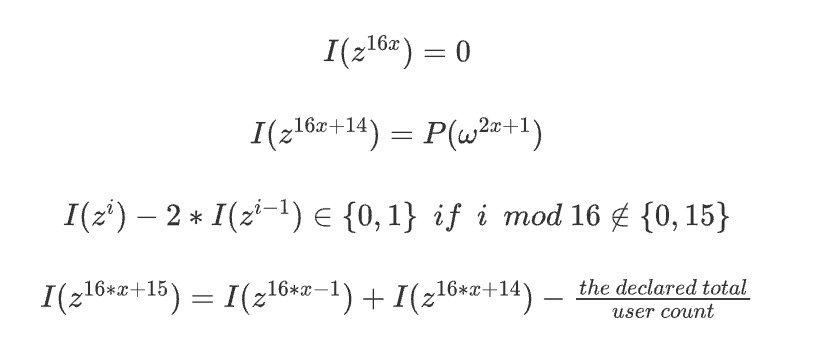

Meanwhile, crypto regulates with code. Here are some ways from Vitalik for how we would implement Proof-of-Solvency.

Not word salad, but math salad. Strong “shape rotator” energy.

Moving away from crypto’s role (or non-role) in this specific bank crisis, I actually think crypto’s main value-add is to help us see TradFi from a parallel degen lens.

For example, yes, banks are just undercollateralized stablecoins!

Or you know The Fed’s fancy new BTFP program from above? It allows banks to use 10-year HTM securities as collateral to access short-term cash. The crazy thing is that it allows them to do this at PAR, which is the original price, instead of what SVB needed to do, which is sell them for a loss.

Martin helps us put this in crypto degen language:

Same financial engineering, different language.

IV. What next?

This is a dEvEloPiNg sToRy and there are many other things I could say here. Here are a few:

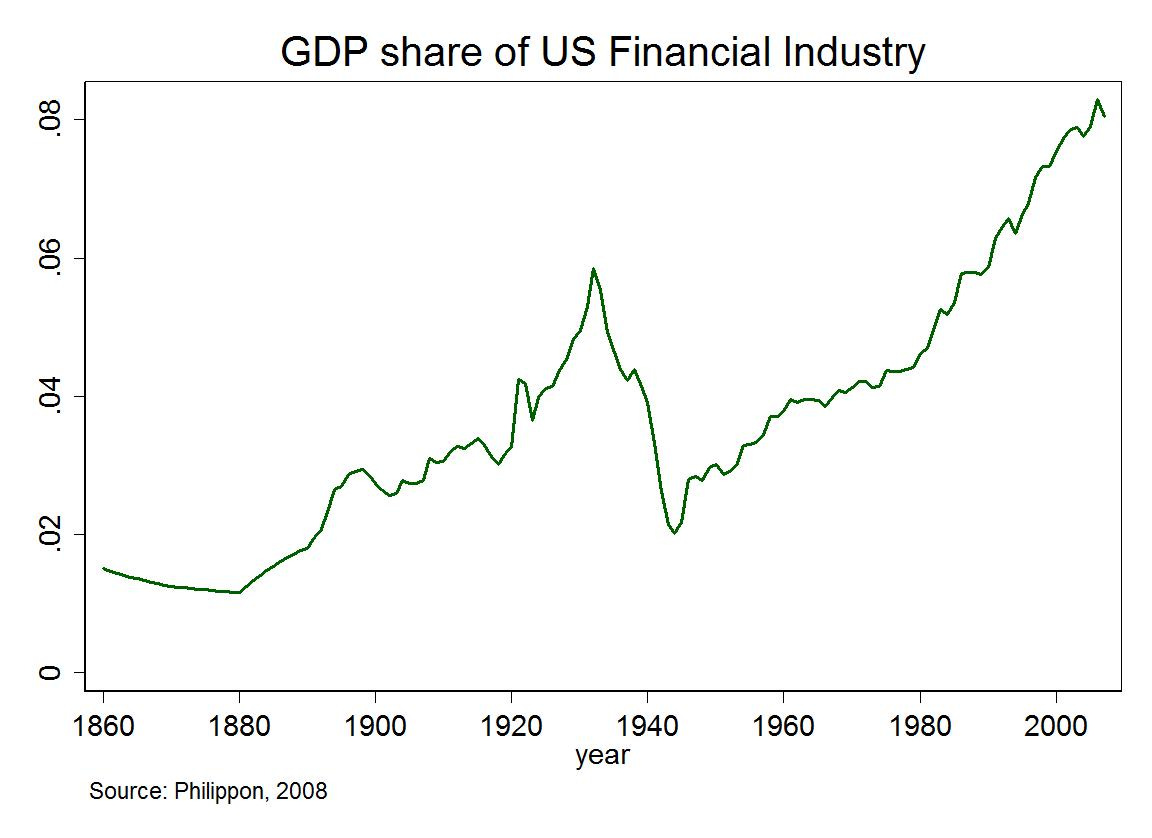

First, we’re at peak financialization. This is Bad™.

Finance isn’t use-less, but it’s not use-ful either. A bit of arbitrage here, a bit of securitization there, sure. But that shouldn’t be 8% of the economy. It should be 1%, tops. WTF Happened in 1971.

I’d love an economy with one-click taxes, two-click mutual funds (how risky, what time horizon), and not much else.

It would be cool if Physics PHDs did actual physics instead of being lured by high-frequency trading firms. Do real fusion, safe nuclear, whatever.

Plz automate finance like we’ve automated farming, factories, and the rest. (While still keeping humans in the loop as circuit breakers.)

More narrow banks, less fractional-reserve banking.

As part of less financialization, we may need to—gasp—decrease bank profitability. This happened after 2008 excess, and as Noah Smith and Sriram note, will likely happen with SVB here.

Second, we need to recognize that the world runs on Internet Time now. This means that:

a) We need more circuit breakers. If something is going crazy, like $42B of outflows in one day, maybe that should trip the breaker. The SEC implemented Limit Up and Limit Down for stocks and securities. Look for something similar but with banks.

b) In addition to interest rate risk & credit risk, banks should pay more attention to social media risk. This was a viral bank run.

Plus, as Lulu Cheng notes here, SVB seriously messed up their comms around this. TradFi could learn from crypto. Control the memes to control the world.

Third, like COVID, a reminder to follow those who were on this trail early:

Seeking Alpha on Dec 19:

Raging Capital Ventures on Jan 18:

And finally, Byrne Hobart on Feb 23:

V. Parting memes

I’ll leave you with a few parting memes.

First, is fractional reserve banking even good?

Second, what is the middle way here?

And finally:

Hope you have a great week!

Warmth, Rhys

❤️ Thanks to my generous patrons below ❤️

If you’d like to become a patron to help us map & build the frontier, please do so here. Thanks!

Stardust Evolving, Doug Petkanics, Daniel Friedman, Tom Higley, Christian Ryther, Maciej Olpinski, Jonathan Washburn, Audra Jacobi, Patrick Walker, David Hanna, Benjamin Bratton, Michael Groeneman, Haseeb Qureshi, Jim Rutt, Brian Crain, Matt Lindmark, Colin Wielga, Malcolm Ocean, John Lindmark, Ref Lindmark, Peter Rogers, Denise Beighley, Scott Levi, Harry Lindmark, Simon de la Rouviere, Jonny Dubowsky, and Katie Powell.